2 CHARTS: US GDP to sink by 30% – U.S. Stocks Sink After Latest Stimulus Deal Fails: Markets Wrap – Falling more…

(005875.811-:E-000062.43:N-AC:R-SU:C-30:V)

[The Jews want Trump out. The markets are lower than when Trump was elected. Jan]

U.S. stocks faded as investors saw little progress on a congressional spending package to blunt the fallout from the coronavirus pandemic. Measures of corporate credit risk eased after the Federal Reserve announced a massive second wave of initiatives to support a shuttered American economy.

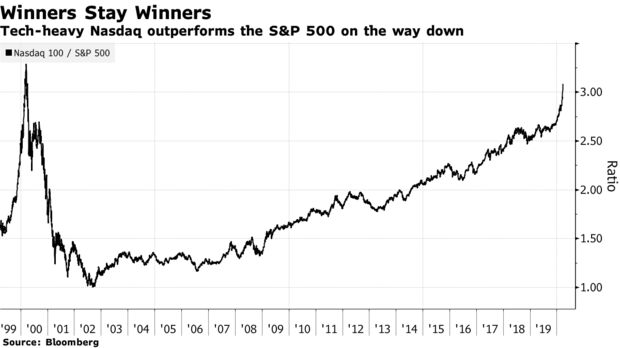

The S&P 500 fell after lawmakers failed to agree on a stimulus bill over the weekend and again fell short of the needed Senate votes on Monday. Tech shares outperformed, with the Nasdaq 100 fluctuating, as negotiations continued on Capitol Hill. House Speaker Nancy Pelosi said the Democrats would release their own plan after rejecting the Republican proposal.

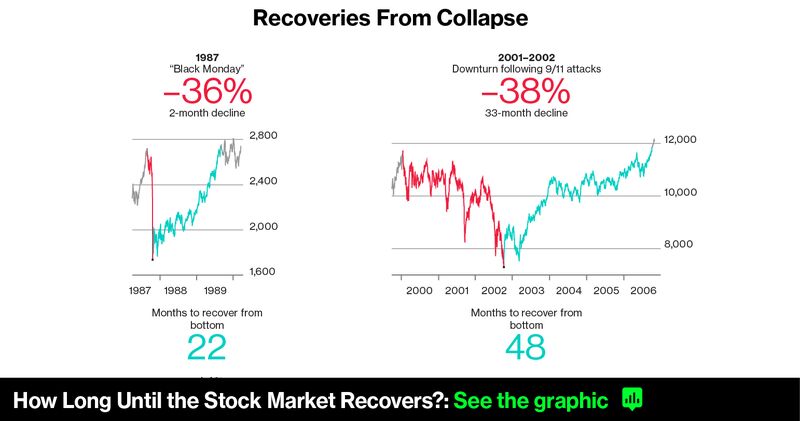

The S&P is down almost 35% from its Feb. 19 record and is headed for the lowest close of Donald Trump’s presidency. The Dow Jones Industrial Average dropped as much as 5% at one point on Monday, losing all its gains since he was elected on Nov. 8, 2016.

“Fiscal is far more important than the Fed in stabilizing risk assets,” said Dennis DeBusschere of Evercore ISI. “That being said, as the Fed gets more creative, they can become much more relevant. They are going to buy everything.”

The central bank said it will buy an unlimited amount of bonds to keep borrowing costs low and will set up programs to ensure credit flows to corporations and state and local governments. The cost to insure against corporate defaults fell and bond ETFs eligible for Fed purchases jumped.

“The Fed has really rallied to do as much as it can to extend its reach, but I think at the end of the day, the markets recognize this requires a fiscal response,” said Nela Richardson, an investment strategist at Edward Jones. “Every time the Fed takes a strong step forward there’s a kind of, ‘Oh no, this is worse than anyone thought’ reaction in the market.”

The Stoxx Europe 600 fell as the continent’s leaders sought to impose more curbs on people’s movements and Italy began shutting most industrial production. Core European bonds climbed. Equities fell earlier across most of Asia, where India’s benchmark plunged a record 13% while the rupee sank to the lowest ever amid moves to lock down widespread areas of the country. Brent crude stabilized after its 20% decline last week; West Texas crude gained, as did gold.

Investors are beginning another dramatic week digesting slashed economic forecasts and news of Europeans struggling to curb the pandemic, with Italy and Spain reporting 2,000 deaths over the weekend between them. Warnings grew that a global recession is coming as cities from New York to Los Angeles all but shut down and cases rise rapidly outside Asia.

Morgan Stanley warned the epidemic could cause U.S. GDP to shrink a record 30% in the second quarter. Federal Reserve Bank of St. Louis President James Bullard said the country’s jobless rate may hit 30%.

Meanwhile, international air carriers continued to announce drastic measures to cope with the outbreak, with giants Emirates and Singapore Airlines Ltd. among the latest to slash flights, and jet maker Airbus SE withdrawing its earnings guidance.

V03: Intense Jewish HATRED for the 2nd Hitler: Dr Hendrik Verwoerd of S.Africa

Many South Africans are not even aware of the enmity between Verwoerd and the Jews. In this video we take a look at Verwoerd and what his opinion was of the Jews and the actions he thought should be taken against them. We also look at how much the Jews hated him.

2005: S.Africa: Military Museum The White Plot to build a Nuclear Bomb

just have to tell you all about this. Last night on TV news, there was our Minister of Defence Mr Lekota who did the unthinkable.

Jan‘s Videos about Rhodesia

Here is a list of most (but not all) of my videos about Rhodesia...